What Do Texas Business Brokers Do?

For circumstances, the seller of a business typically sees the business as his/her “baby,” and consequently position a worth on it that may be higher than its actual worth – Freedom Factory,Texas Business Broker. Similarly, a purchaser may fail to value the quantity of work associated with developing a business to a certain point.

The Importance of Utilizing a Texas Business Broker

As Susan Pravda and Gabor Garai observed in Mergers and Acquisitions, the process of securing an arrangement normally is a multi-faceted one. When a business broker brings an interested purchaser and seller together, he or she often tries to set a target date for conclusion of the transaction. This is generally accomplished by means of a letter of intent in which the purchaser and seller accept move towards a deal. Buying or Selling a Nevada Business? Ten Questions to Ask

Buying or Selling a Nevada Business? Ten Questions to Ask

Sell Your Business In Texas

Freedom Factory

5500 Greenwood Plaza Blvd #230

Greenwood Village, CO 80111

(844-629-8258)

www.FreedomFactory.com

A wide range of considerations need to be considered here, consisting of value of inventory, worth of accounts receivables, value of neighborhood goodwill, inclusion or exclusion of devices in final purchase price, tax issues for both buyer and seller, and so on. Another possible barrier to a sale that typically emerge around this time is “seller’s remorse.” Seller’s regret typically takes place during the latter phases of settlements, when the seller unexpectedly realizes that he/she is giving up control of the business that has been a cornerstone of his/her life (and often the life of his/her whole family) for numerous years.

Top Texas Business Brokers In Texas

After the structure for an arrangement has actually been reached, the service brokering procedure carry on to due diligence, where different legal technicalities which could ward off an otherwise legal plan are determined and addressed. For instance, the buyer may desire to guarantee that he or she was obtaining the legal rights to all patents held by the firm.

In the last phase, the broker assists the buyer and seller iron out and sign a last agreement. This stage is the one more than likely to involve using attorneys on both sides, even for smaller sized transactions. The very best method for the broker to reduce the opportunity that the deal will stop working at this vital point is to attempt to deal with all concerns and issues in the letter of intent and due diligence phases.

At this moment, the broker’s knowledge as arbitrator and peacemaker is essential to making sure that the deal goes through. BUSINESS BROKERS AND THE ENTREPRENEUR Business brokers can be invaluable to both purchasers and sellers of little companies, however the quality of these representatives can differ tremendously. Organization brokerage firms have actually traditionally been a notoriously uncontrolled group, and while there have been some enhancements in this regard in recent years, problems about incompetence and/or doubtful organization practices still emerge.

What Is A Texas Business Broker And Why Should You Use One

How to Tell Your Texas Business Broker is Screwing You

There are, obviously, certain standard sort of information that any purchaser or seller ought to get when shopping for a business broker. “When you’re trying to find a broker to help you buy or offer a service, inquire about the broker’s level of experience and pursuit of continuing education,” counseled Country’s Company – Texas business broker.

However there are other steps that can be taken as well, as company executive Shannon P. Pratt informed Inc. publication. For instance, a broker’s record of sales as a proportion of total listings can supply substantial insight into his/her abilities. Brokers who are unable to provide sales on more than 50 percent of listings on the market for 6 months to a year must most likely be avoided.

Other suggestions that Pratt provided to Inc (Tyler Tysdal). consisted of the following: Determine how typically the broker’s listing rate represents the ultimate list prices. “I ‘d be far more positively inclined to work with a brokerage if its typical asking price is within at least 20% of the average listing price,” said Pratt.

What Is The Typical Texas Business Broker Fee? Who Pays It

Inquire whether the broker focuses on particular geographical regions or industries. A broker who has actually primarily dealt with production companies may not be the very best option to help an organization owner offer his or her restaurant. Try to find tell-tale indications of unethical or unskilled behavior. Does the broker accept fake listings (those that are noted at unbelievably inflated rates or owned by owners uncertain of their desire to offer)? Has the representative too soon leaked personal info about your business to potential buyers? Is the broker positively changing a business’s income statement to an extreme degree? Sadly, these signs frequently emerge only after a buyer or seller has actually established a relationship with the representative.

Running a business is tough work whether it’s physical or ecommerce. Working for yourself has a lot of benefits, nevertheless. That’s why being a business broker is appealing for numerous business owners. Rather of running the day to day of the same operation, a business broker is constantly working with different people and business to assist them with what they require – Tyler Tysdal.

What Is Private Equity also what does Private Equity Companies Do?

Read More

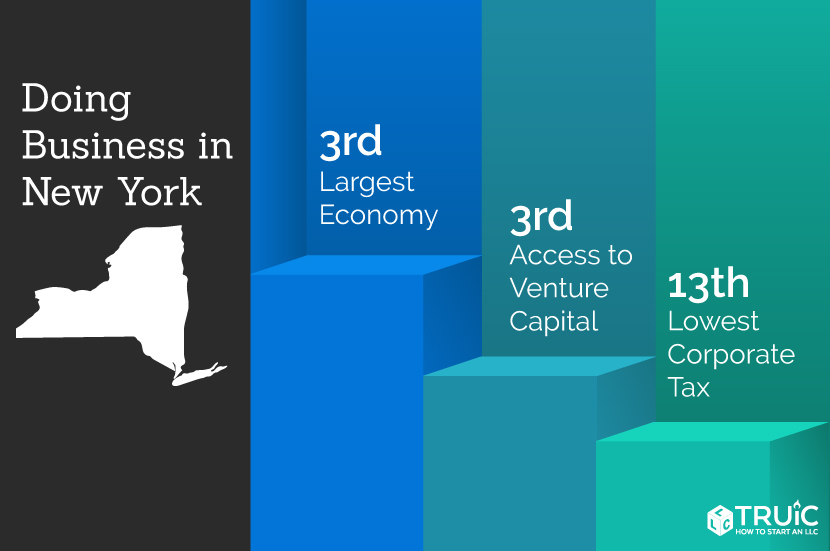

What Does a New York Business Broker Do?

What Does a New York Business Broker Do? 5 Tips for Finding a New York Business Broker

5 Tips for Finding a New York Business Broker